Archive for the ‘Tax Hikes’ Category

If Federal Taxes on Cigarettes Deters Smoking, Does Federal Taxes on Earnings Deter Working?

Tuesday, October 22nd, 2013Democrat Congressman Keith Ellison: “There’s Plenty of Money, The Govt Just Doesn’t Have It”

Tuesday, August 6th, 2013

(CNS News) Minnesota Democrat Congressman Keith Ellison, speaking to a group of fellow Democrat/Socialists at the ‘Progressive Democrats of America’ roundtable on the 25 July according to Red Alert Politics made the startling announcement that the federal government isn’t as bad off as it may seem.

“The bottom line is we’re not broke, there’s plenty of money, it’s just the government doesn’t have it–the government has a right, the government and the people of the United States have a right to run the programs of the United States–Health, Welfare and Housing…all these things.”

On the 25 July, I wrote here that Pro-Golfer Phil Mickelson from California, walked away with $21.6 Million in just two weeks after winning both the ‘British Open Championship & Scottish Open’ but after paying all of the taxes owed on his winnings which included the new ObamaCare Medicare Surtax and handed over 13.3% to the State of California, Forbes estimated that Mickelson would have left $842,700 which doesn’t include any tax deductible travel expenses and the additional 10% he owes his Caddy.

Where does the government ‘get the right’ to confiscate more and more of the American peoples wealth?

When is enough, enough?

Pro-Golfer Phil Mickelson Faces 61% California Tax Following Historic British & Scottish Open Wins

Thursday, July 25th, 2013 California Taxes –Cartoon Image: Branco Cartoons

California Taxes –Cartoon Image: Branco Cartoons

(CBS Los Angeles) Thanks to Pro-Golfer Phil Mickelson recent wins at both the ‘British Open Championship & Scottish Open’ and walking away with more than $21.6 Million in just two weeks, Mickelson now faces a 61% tax rate at home in California thanks to recent changes in how income is confiscated.

According to Forbes Mickelson has been subjected to the United Kingdom’s 45% tax rate, in addition he will be taxed on a portion of his endorsement income earned during his time in Scotland.

While Mickelson can take a foreign tax credit to avoid being double taxed again by the U.S. Govt, he still must pay self-employment taxes, ObamaCare’s new Medicare surtax and hand over 13.3% of his wages to the State of California which doesn’t have a foreign tax credit.

Forbes estimates that Mickelson will take home $842,700 which of course does not include any of his tax deductible travel expenses and the additional 10% he owes to his Caddy.

In January, Mickelson created quite a media frenzy when he said that he was unsure if he could afford to continue to live in California and according to Breitbart News Mickelson said that he will have to make some “drastic changes” after the federal govt and the State of California raised the rates at which his income is taxed.

California Tax Revenue Fall After Prop 30 Tax Hike

Friday, June 14th, 2013

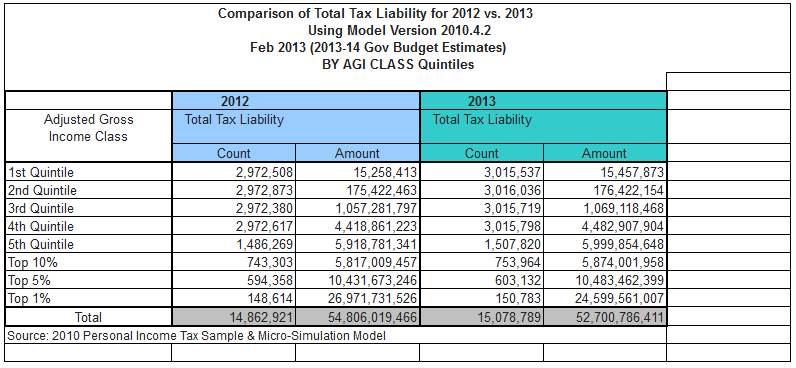

(Cal Watchdog) According to the Franchise Tax Board, the highest 1% of income earners will pay more than $2 Billion less in taxes in 2013 than last year.

That’s not surprising, a recent survey found that 75% of affluent California residents are planning actions to reduce their tax liabilities and the other 25% are considering exiting California all together.

On the 14 May, 2012 I wrote here that California’s out of control budget crisis is a result of overly burdensome regulations, ever increasing taxes and out of control spending–the present economic catastrophe unfortunately was all too predictable and the only solution remains is a robust supply-side economic plan that will create incentives for real economic expansion, resulting in an increasing tax base and new revenue streams.

The news of falling tax revenues once again proves this correct.

3 Major Health Insurers Flee ObamaCare California

Wednesday, May 29th, 2013 ObamaCare –Image Courtesy: Barracuda Brigade

ObamaCare –Image Courtesy: Barracuda Brigade

(Catholic Online) ObamaCare is scheduled to go into effect in 6 months–the key provision of the Obama Administration, the package is intended to mandate that individuals carry health insurance and require that health-benefit providers are spending at least 80% of premiums collected on health care for their insureds.

However in the State of California, three major health insurance providers (United Health Group, CIGNA & AETNA) are setting out of the state’s health insurance exchange. Why would these major insurance carriers decide to opt out of one of the largest insurance markets in the nation if there isn’t any inherent problems with how ObamaCare functions?

What do they know that you don’t?

The Motley Fool points out that the most optimistic scenario calls for around 5 million people to purchase health insurance through the California/ObamaCare Exchange–the flood of new insureds would enable those insurance carriers participating in the exchange to make money on higher volume while offering insurance at lower rates–Capitalism at its finest right?

A gloomier and more likely scenario is that a much lower number of people will purchase insurance through the exchange, possibly causing the insurance carriers participating to lose money because they based their rates on overly rosy assumptions.

While we won’t know which scenario will unfold for a while there are some cost comparisons to keep in mind. An individual may be able to purchase insurance through Kaiser for as little as $82 a month–but the state has an estimated 7 million people without health insurance. Even with subsidies, a 21 year old (who decides to opt out of her/his parents health insurance plan) making $35,000 annually will have to pay about $64 a month for the least expensive ObamaCare plan–around 2.6 Million residents will likely qualify for some level of federal subsidies, leaving around 4.5 Million currently uninsured with no financial subsidies–ObamaCare advocates believe these people will now run out and buy health insurance.

Riiight…

The other cost to keep in mind is $95 that is the penalty tax (for the entire year) that a person must pay to the IRS if she/he doesn’t buy health insurance. Will individuals pay $82 a month now for health insurance or will they go with the much cheaper penalty tax?

One other major fact to always keep in mind, under ObamaCare’s own rules, health insurance carriers can no longer decline to insure someone for pre-existing health conditions. How many young and healthy Americans will decide to decline purchasing health insurance now, pay the $95 annual penalty tax and only decide to go out and purchase a policy of health insurance when necessary?

While United Health, CIGNA & AETNA combined only represent about 7% of the total health insurance market, the message that these insurers are sending to California is much more important–these companies are still very skeptical as to how things are going to play out with the ObamaCare exchanges.

The State of California may offer a wealth of possibilities but its simply not worth the price of admission based on United Health’s decision to opt out of the ObamaCare exchange–a lack of large national insurance presence in California is only bound to increase mounting skepticism over how effective the exchange will ultimately be in manufacturing competition among insurers.

In return of a lack of of recognizable insurance names could diminish consumer interest in researching the health plans, which will defeat the entire purpose of setting up the ObamaCare exchanges.

Congress Is Now Preparing to Raise Even More Taxes, This Time On Influenza Vaccines

Thursday, April 25th, 2013 Throw Them All Out –Image: Linda Scharf Brazier

Throw Them All Out –Image: Linda Scharf Brazier

(Weekly Standard) Congress is preparing to take bipartisan action to raise even more taxes this year. This latest tax gimmick would raise impose a federal tax on Americans that take a preventive flu vaccine.

Along with taxes on other vaccines this tax money grab from Washington would allegedly find the Vaccine Injury Compensation Fund a “no-fault” compensation fund to resolve torts of persons that have been injured by certain vaccines.

How long would it be before this new fund is raided by politicians and bureaucrats to pay for projects other than what this latest new tax is said to be designated for?

Taxes & Economic Prosperity –Image: Lana Wong@Facebook

Taxes & Economic Prosperity –Image: Lana Wong@Facebook

Tax Increases Courtesy of ObamaCare –Heritage Foundation

Tax Increases Courtesy of ObamaCare –Heritage Foundation Wannabe Dictator-King, President Obama –Image: Media Circus

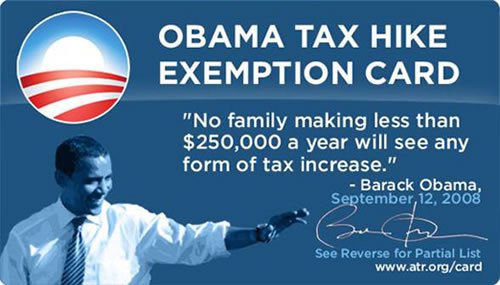

Wannabe Dictator-King, President Obama –Image: Media Circus  Obama’s Tax Hike Exemption Card –Image: Nothing But The Facts

Obama’s Tax Hike Exemption Card –Image: Nothing But The Facts Obama: Rich Should Pay Their Fair Share –Image: Memegenerator

Obama: Rich Should Pay Their Fair Share –Image: Memegenerator