Texas Continues its 10 Year Historical Position as the Best State

Texas Continues its 10 Year Historical Position as the Best State

Overall for Business in 2014

Florida Ranks #2 is Edging Up and Even Overtaking Texas in its

Florida Ranks #2 is Edging Up and Even Overtaking Texas in its

Quality of Living Environment

California Ranks Dead Last as the Worst State for Business in 2014

California Ranks Dead Last as the Worst State for Business in 2014

(Chief Executive.net) In the 10th annual survey of CEO’s concerning their views of the best and worst states for business, over 500 CEO’s across the United States responded, grading states which they were familiar on measures including taxes and regulatory regime, the quality of the workforce and the quality of the living environment.

California, New York and Illinois continue to rank among the worst three states for business with virtually no change from 2013

What CEO’s are saying about California:

- California goes out of its way to be anti-business and particularly where one might put manufacturing and/or distribution operations;

- California continues to lead in disincentives for growth businesses to stay;

- California’s attitude toward business makes you question why anyone would build a business there;

- We relocated our corporate office from Los Angeles to Atlanta in 2006 largely because of the regulatory and unfriendly tax environment in the State of California. We considered Dallas but settled on Atlanta for customer-related and other secondary or marginal reasons. Would make the same decision if I had to do it all over again;

- California could hardly do more to discourage business if that was the goal. The regulatory, tax and political environment are crushing. The only saving grace is that there are still a lot of affluent areas that drive local economic zones but the trend line on these is not good for the mid to longterm.

Read full report here from Chief Executive.net

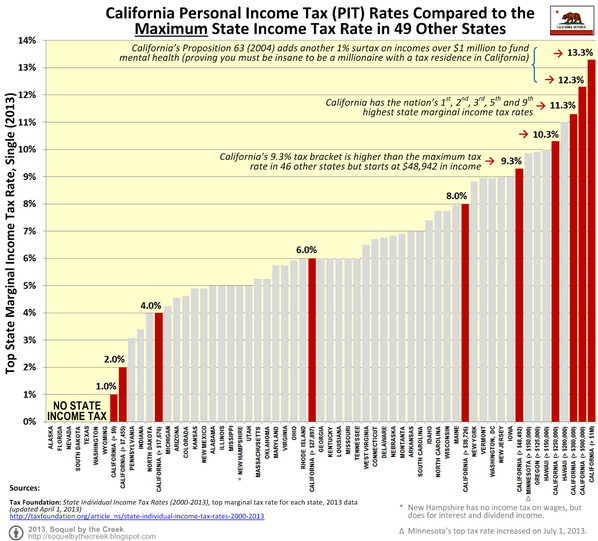

California Has the Nation’s Highest State Income Tax Rates

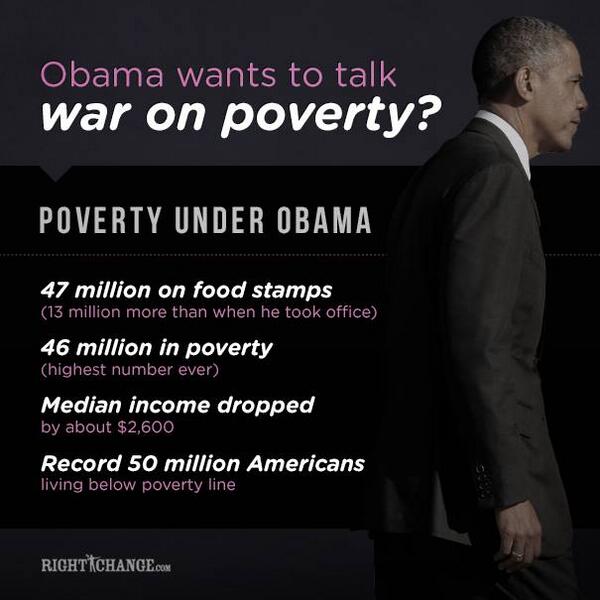

California Has the Nation’s Highest State Income Tax Rates Obama’s Record: War on Poverty –Image: Right Change@Facebook

Obama’s Record: War on Poverty –Image: Right Change@Facebook

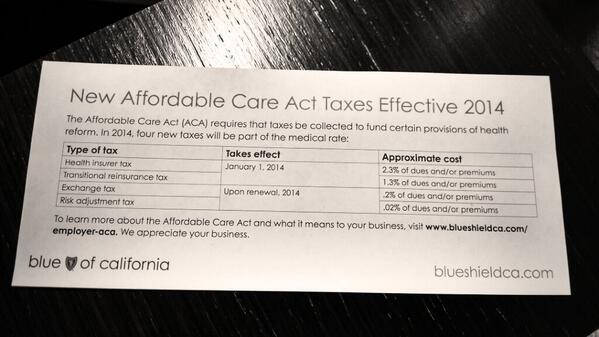

“Not happy with Covered California. Waited in online queue to get help and heres what I got.” –Image: Frank Sosa@Twitter

“Not happy with Covered California. Waited in online queue to get help and heres what I got.” –Image: Frank Sosa@Twitter New York Times Opposed First Income Tax

New York Times Opposed First Income Tax ObamaCare Death & Taxes –WTP@Twitter

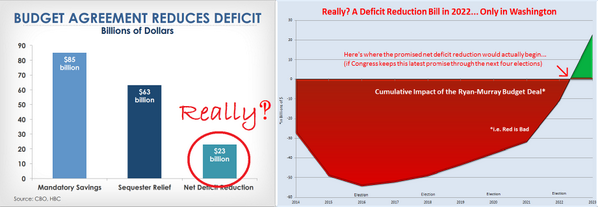

ObamaCare Death & Taxes –WTP@Twitter Ryan-Murray Budget Deal Breaks the Sequester Promise of 2011 to Cut Spending a Decade Later –Rep Tim Huelskamp (R-KS)@Twitter

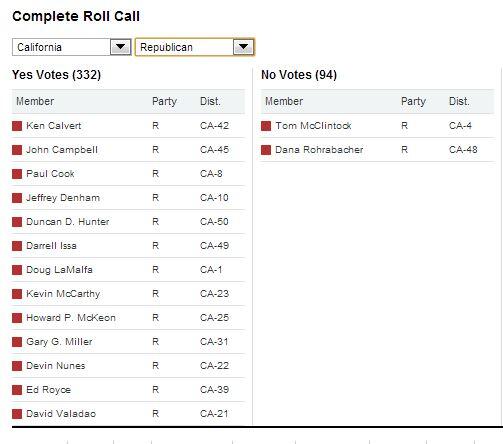

Ryan-Murray Budget Deal Breaks the Sequester Promise of 2011 to Cut Spending a Decade Later –Rep Tim Huelskamp (R-KS)@Twitter California RINO’s That Supported Budget Busting Betrayal

California RINO’s That Supported Budget Busting Betrayal In the Ryan-Muuray Budget “Deal” Americans Will Now Have to Pay More For This –Sen Rand Paul (R-KY)@Twitter

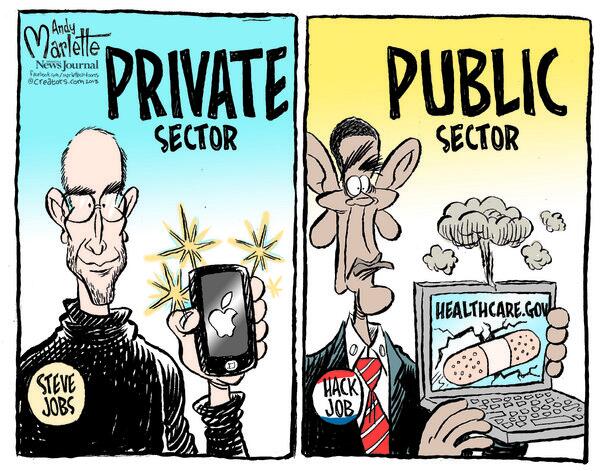

In the Ryan-Muuray Budget “Deal” Americans Will Now Have to Pay More For This –Sen Rand Paul (R-KY)@Twitter ObamaCare Website Failures Explained –Seth@Twitter

ObamaCare Website Failures Explained –Seth@Twitter