Malibu Rental –Image: AceRenting@Twitter

Malibu Rental –Image: AceRenting@Twitter

(LA Times) Rental home costs are going to continue to rise–nearly 78% of Southern California apartment building owners say they plan to hike rents in the next 12 months according to a new survey from real estate broker Marcus & Millichap about 22% plan to increase rents by at least 3%

On the 04 June, I wrote here that over half of Americans reportedly are already struggling to keep their homes and the problem is only going to get worse.

In April, ‘Curbed LA’ Published a Chart Showing the Best & Worst Rental Prices Throughout Los Angeles Area

In April, ‘Curbed LA’ Published a Chart Showing the Best & Worst Rental Prices Throughout Los Angeles Area

Say Good-Bye to Prop 13 ?

In May, The Sacramento Bee–Capitol Alert reported after decades of wrangling by Democrats (that just can’t seem to confiscate enough of taxpayers money to spend, I digress) during a hearing of the ‘Assembly Revenue and Taxation Committee’ lawmakers agreed on changes to the 1978 law governing reassessments of commercial property when it changes hands, citing one of their old stand-by favorite liberal arguments ‘fairness’ of the tax system, as if voters were not smart enough when Prop 13 passed by a 2 to 1 margin.

Will confiscating more money from commercial/business property owners actually result in more “fairness” that Democrats like to claim or just raise the costs of doing business and make things (such as rental costs) more expensive?

The latter of course, as Forbes correctly points out–Corporations (such as rental property owners) don’t pay taxes they pass on their business costs and expenses to their customers or in this case, to their tenants in the form of higher rents.

Why is it that California voters continue to reelect liberals to Sacramento is anyones guess–Just as, how many licks does it take to get to the ‘Tootsie Roll’ center of a “Tootsie Roll Pop” the world may never know?

Related: Squeezing Out the Working Class Through Higher Rents

Lack of Housing Trouble–That Might Be Trouble –LA Register

(Catholic Online) With the Exception of Two States,

(Catholic Online) With the Exception of Two States, 2014 Midterms: Its About Obama’s Scandals Stupid —

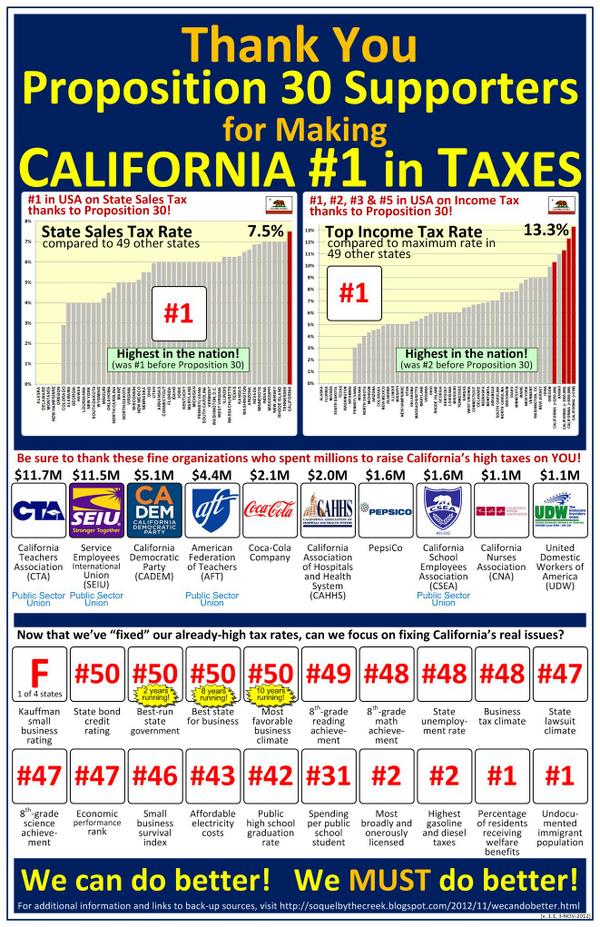

2014 Midterms: Its About Obama’s Scandals Stupid — Thanks California Prop 30 Supporters for Making the State #1 in Taxes

Thanks California Prop 30 Supporters for Making the State #1 in Taxes California’s Anemic Job Growth Compared to the State of Texas with Smaller Population & Economy –Image: Soquel by the Creek@Twitter

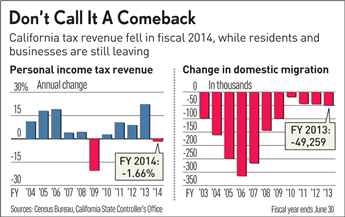

California’s Anemic Job Growth Compared to the State of Texas with Smaller Population & Economy –Image: Soquel by the Creek@Twitter California’s Gov Jerry Brown’s Tax Hike Has Sent Tax Revenues

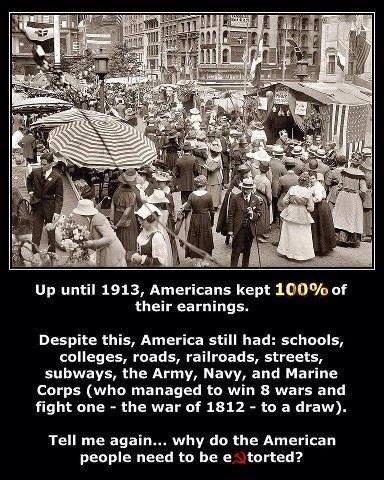

California’s Gov Jerry Brown’s Tax Hike Has Sent Tax Revenues Federal Income Tax Failure –Image:

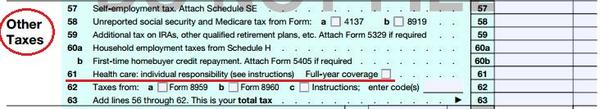

Federal Income Tax Failure –Image:  New IRS Draft Form 1040 Proves that Obama Repeatedly Lied About Individual Mandate Tax –Image:

New IRS Draft Form 1040 Proves that Obama Repeatedly Lied About Individual Mandate Tax –Image:  Gotta Love It When ‘Team Obama’ Puts Their Lies in Writing

Gotta Love It When ‘Team Obama’ Puts Their Lies in Writing Malibu Rental –Image: AceRenting@Twitter

Malibu Rental –Image: AceRenting@Twitter  In April, ‘Curbed LA’ Published a Chart Showing the Best & Worst Rental Prices Throughout Los Angeles Area

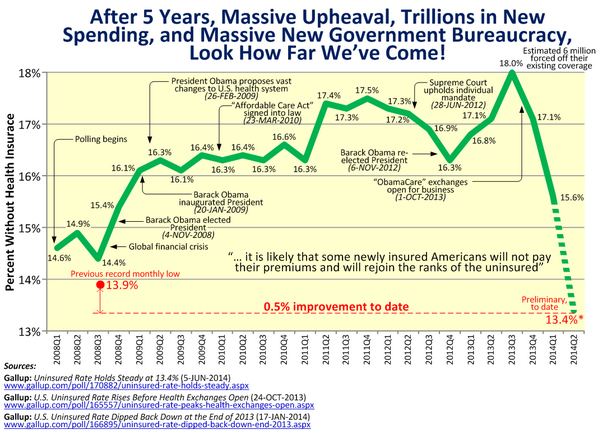

In April, ‘Curbed LA’ Published a Chart Showing the Best & Worst Rental Prices Throughout Los Angeles Area  The Liberal Left Claims the Percentage of Uninsured is the Lowest in History–That is if History Began in 2008 –Image: Soquel Creek@Twitter

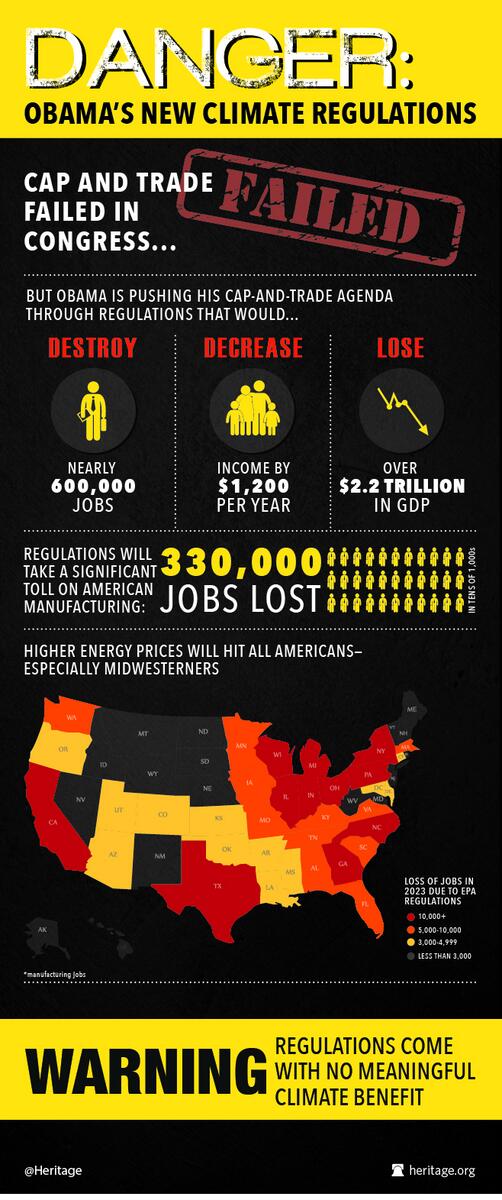

The Liberal Left Claims the Percentage of Uninsured is the Lowest in History–That is if History Began in 2008 –Image: Soquel Creek@Twitter Wannabe King Obama Will Bypass Congress (Again) to Implement

Wannabe King Obama Will Bypass Congress (Again) to Implement

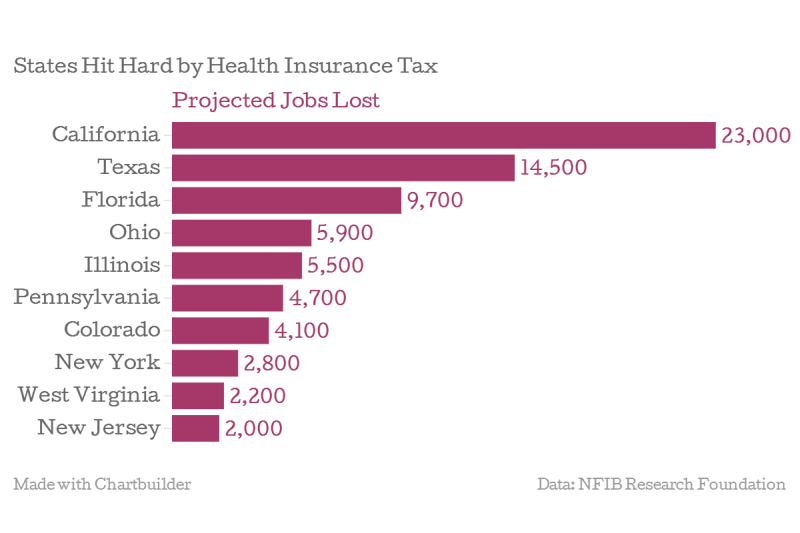

ObamaCare ‘Health Ins Tax’ Could Cost Up to 286,000 Jobs

ObamaCare ‘Health Ins Tax’ Could Cost Up to 286,000 Jobs