Claiming that an increase in oil taxes of .32 cents a barrel will help finance clean-ups, Congress is poised to quadruple taxes on a barrel of oil.

Who really pays? Oil Companies will pass on any new tax increases on the consumer.

Federal, State and Local Taxes are the second largest part of the retail price of gasoline. In 2008 federal excise taxes were 18.4 cents a gallon and state excise taxes averaged 21.7 cents a gallon. From 2000 to 2008 taxes averaged 23% of the retail price of a gallon of gasoline.

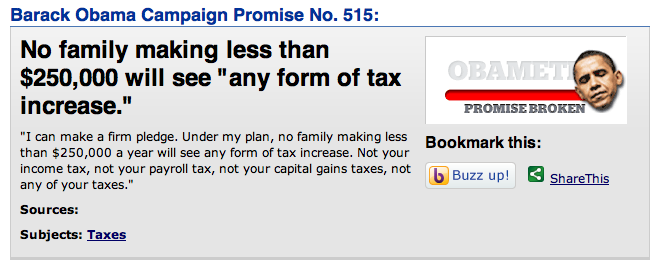

Remember when, “Hoax & Chains” promised…

Having already broken his no new tax pledge will Barack Obama sign legislation raising oil taxes?

New federal taxes are most assuredly coming. Get ready to dig a little deeper in your pocket and tighten your belt a little bit more.

More here from Politifact.com

Tweet